Investment in oil, nearly 50% of system semiconductor funds are exhausted.

Accumulated investment of 14 billion won, forecast to complete investment next year

GU Investment is speeding up the exhaustion of investment funds for the 30 billion won fund that was formed last year. It seems that they are focusing on investing in No. 3 funds as they have finished investing in No. 1 and No. 2 blind funds. The exhaustion rate reached 50 percent within a year of formation. Considering that investment destinations are limited special funds, they are quickly exhausted.

System Semiconductor Fund is the third blind investment association formed by Jiu Investment since its launch in 2017. As the fund has exhausted both the first and second funds, the company plans to start additional fund-raising.

◇Expiration rate for 1 year has been exhausted, and investment speed is fast considering special funds.

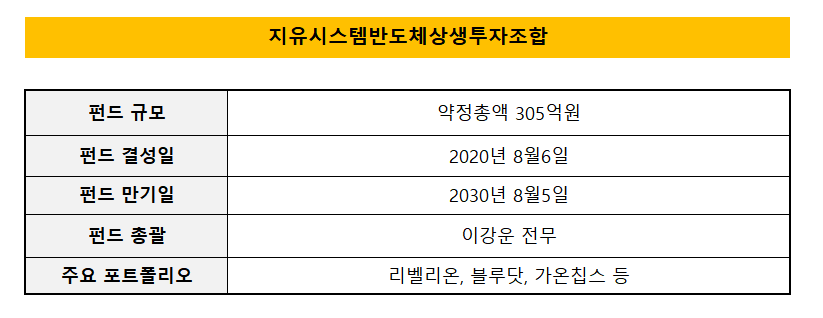

According to related industries on the 4th, GU Investment has exhausted 14 billion won out of 30.5 billion won in investment funds from System Semiconductor Win-Win Investment Association, which was formed in August last year. The exhaustion rate is 45.9 percent.

System Semiconductor Fund was established and launched by Korea Growth Finance along with Samsung Electronics and SK Hynix last year. As system semiconductor is evaluated as the fundamental industry of 4th Industrial Revolution, it greatly increased its investment ratio and set it as 99%.

GU Investment formed the fund when it was selected as the final entrusted operator (GP) in the first round of investment projects. It received 30 billion won out of 30.5 billion won from an anchor investor and completed the process in August last year. The date of existence is until August 5, 2030, and the base rate of return is 5%.

System semiconductors are not easy to find investment targets and require expertise. For this reason, the capacity of a house is of paramount importance. GU Investment, which was launched in April 2017, was the first generation of venture capitalists, led by CEO Yang Jung-kyu, who served as CEO of Aju IB Investment. Its members are also experts who have gone through Samsung Semiconductor Research Institute, Samsung Advanced Institute of Technology, and Samsung Electronics.

Executive director Lee Kang-woon, who is in charge of the fund, is an engineering doctor from KAIST who entered the venture capital industry through ATINUM INVESTMENT after serving as a researcher at Samsung Electronics' semiconductor process. Currently, he is in charge of two funds in Jiu Investment, including System Semiconductor Fund.

◇Preparation of some IPOs out of 7 Portfolio sites and exit green signals

◇Preparation of some IPOs out of 7 Portfolio sites and exit green signals

Until now, there are seven portfolios that are included in System Semiconductor Fund. Rebellions, Blue Dot, GAONCHIPS and others are considered major portfolios.

Rebellions recently closed its investment round for FreeA worth 14.5 billion won. Rebellions has drawn attention as a venture company composed mainly of engineers who have gained experience in foreign semiconductor companies. In May, Moon Jae-in, organized by the president by attending a ‘semiconductor strategy report and k’ profile was a lot higher.

Established last year, Rebellions has been recognized for its growth potential and has been receiving investment support from local institutional investors. The funds raised in the seed investment round were 5.5 billion won, with Kakao Ventures, Shinhan Capital, GU Investment and Seoul National University Technology Holding participating. They continued to support growth by following-on in the free-A round.

Blue Dot is a cloud-based system semiconductor IP service company and is a technology venture established in August 2019. Since attracting seed investment from Square Ventures, BluePoint Partners, and Pohang University of Science and Technology Holding last year, it has received additional investment from Naver D2SF, Smilegate Investment, KB Investment, Bluepoint Partners, POSTECH Holdings, and Square Ventures this year. GU Investment also participated in this round and was named.

GU Investment plans to build a portfolio through its third fund, as investment in the first and second blind funds has been completed. Currently, more than half of the seven portfolios have been selected as organizers. As IPOs are becoming visible, expectations for Exit are also high.

"We are currently focusing on investing in the No. 3 fund," a source at GU Investment said. "We are looking at opportunities for new fund-raising because the No. 1 and No. 2 funds have been exhausted."

By Lim Hyo-jung, a reporter

This article was shown on the 13:16 Durbel paid page on August 4, 2021.

www.thebell.co.kr/free/content/ArticleView.asp?key=202108041253188400104149&svccode=00&page=1&sort=thebell_check_time