Mirae Asset Venture-We Ventures to Form 100 Billion Funds

KDB plans to select the head of the department, Blind GP, to form a 'semiconductor specialty' PEF in September.

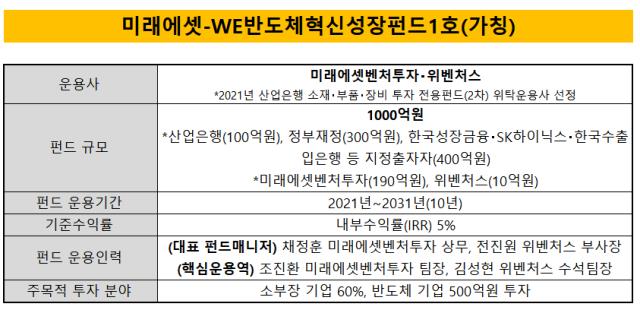

Mirae Asset Venture Investment Co. and We Ventures Co., Ltd. were selected as the consignment management company (GP) for investment in materials, parts and equipment (department head) conducted by the Korea Development Bank. It is going to form 'Future Asset-WE Semiconductor Innovation Growth Fund No. 1', which is a blind fund worth 100 billion won, in the form of Co-GP (Co-GP).

The experience of Mirae Asset Venture Investment, a large fund manager, and We Ventures' ability to deal with early companies are expected to create synergy. It is also expected to add to the fund's management by taking advantage of the two VCs' expertise in semiconductor investment. We Ventures, which has shown remarkable growth, has set the foundation for the fund's enlargement by operating a 100 billion won fund in the third year of its establishment.

According to an industry on the 25th, Mirae Asset Venture Investment and We Ventures were selected as the final GP through a 2 to 1 competition rate in 'Semiconductor Small Manager' account, which is a fund dedicated to investment in materials, parts, and equipment. It is expected that 'Future Asset-WE Semiconductor Innovation Growth Fund No. 1' will be formed in September.

The Fund's major limited liability investors (LPs) are government finance (30 billion won), Korea Development Bank (10 billion won), and designated investment (40 billion won). GPcommitment is more than 1% of the total amount of the agreement. Mirae Asset Venture Investment and Mirae Asset Financial Group will invest a total of 19 billion won and We Ventures will invest 1 billion won. The fund's management period is 10 years and the investment period is five years. The base rate of return was set at 5 per cent on the basis of an internal rate of return (IRR).

The fund formation is in line with the growth strategy pushed by Mirae Asset Venture Investment and We Ventures. Until now, Mirae Asset Venture Investment has been focusing on small fund strategies that focus on venture funds worth between 20 billion won and 30 billion won and investments in unique accounts. However, as the expansion of the fund is inevitable, the company has vowed to expand its operating assets in the wake of its entry into the KOSDAQ in 2019. As venture funds worth 100 billion won and private equity funds (PEFs) were formed one after another based on the public offering funds secured, their assets were worth 800 billion won last year.

Since its establishment, We Ventures has also been exploring early companies in each sector by operating a number of 20 billion won to 50 billion won funds. The formation of the fund is expected to pave the way for the fund's enlargement. This fund also incorporates We Ventures' clear fund management method. The review team, which has expertise in ICT and sub-departmental fields, is responsible for managing only "tailored" funds.

Representative fund managers are Chae Jung-hoon, executive vice president of Mirae Asset Venture Investment, and Jun Jin-won, vice president of We Ventures. Director Chae entered VC industry through Samsung Electro-Mechanics and others, and ICT and small businesses are the main areas of investment. Patron, TmaxSoft, Senko and others are representative portfolios. Jeon, a former vice president of Samsung Electronics and Samsung Venture Investment, has expertise in deep-tech fields at home and abroad such as system semiconductors and artificial intelligence (AI). Its flagship portfolios include Openedge Technology, GAONCHIPS, and Qualitas Semiconductor.

Cho Jin-hwan, head of Mirae Asset Venture Investment, and Kim Sung-hyun, senior team leader of We Ventures, were named as key management personnel. Senior team leader Cho made investments in semi-five, Atlas Labs, and others by making investments in ICT, commerce, and small businesses. Senior team leader Kim built expertise in investment in ICT and FinTech at LB Investment and worked as a director at Kraft Technologies, a FinTech company.

The fund's investment targets sectors such as system semiconductors, major processes and post-processes, future cars and AI, which are the base technologies of the fourth industrial revolution. Major targets for investments are 50 billion won for semiconductor businesses and 60 percent for small business managers. It is predicted that investments in series A and B will be major investments. The company plans to discover promising industries through its internal capabilities and external networks such as CVC by utilizing existing investment company networks and Mirae Asset Securities Research Center.

The fund's non-hickle is a private equity investment company (PEF) specializing in start-ups and ventures. The fund will be completed in September with approval from the Financial Services Commission. "The purpose of this fund is clear, such as creating a domestic ecosystem for semiconductors and fostering the system semiconductor industry," said a former vice president of We Ventures. "We will find competitive companies that can expand the domestic semiconductor ecosystem so that we can contribute to creating a virtuous cycle ecosystem."

By Reporter Lee Jong-hye

This article was shown on the pay page of 15:16 Durbel on May 25, 2021.

www.thebell.co.kr/free/content/ArticleView.asp?key=202105251351199040108851&svccode=00&page=1&sort=thebell_check_time